Through Tax Credits, Exemptions, or Lower Withholding Tax Rates, Tax Treaties give you access to relief from Double Taxation. These reliefs differ from nation to nation and depend on the specific sources of income. Learn more about the double tax agreements that Singapore has.

Examining the problem of double taxation has become more important as a result of the growth of worldwide trade and multinational enterprises. You would naturally be concerned about the issue of taxation if you were a firm or an individual seeking outside of your own nation for business possibilities and investments, especially if you could have to pay taxes on the same income twice: once in the host country and once in your own.

In order to maximize your tax position and lower costs, you would structure your business in a way that would boost your ability to compete globally. The importance of Singapore’s DTAs or tax treaties becomes relevant in this situation.

Treaty clauses are often discriminatory-free and reciprocal (apply to both treaty countries), meaning that you wouldn’t be in a worse tax position than if you were a resident of the tax country. You might still be able to benefit from Singapore’s unilateral tax benefits even if your country and Singapore do not have a treaty.

Double Taxation: What is it?

When two or more countries tax the same taxpayer with regard to the same taxable income or capital, this is known as double taxation. In other words, the same income is subject to taxation in both the country where it is generated and the country where the recipient resides. Countries offer a variety of reliefs to taxpayers to lessen the cost of double taxation, either through domestic tax legislation or through tax treaties they have signed with other nations.

What is a Double Tax Agreement (DTA)?

A DTA is a bilateral pact made between two nations to prevent any potential double taxation brought on by the implementation of their respective domestic tax laws.

Advantages of DTAs

DTAs are Advantageous for Whom?

The DTA can only be applied to benefit residents. According to Section 2 of the Singapore Income Tax Act, a resident is:

By submitting a Certificate of Residence to the foreign country, you can claim relief under the applicable tax treaty if you receive foreign income from a treaty country. This demonstrates your tax residency in Singapore.

The Inland Revenue Authority of Singapore will need a completed Certificate of Residence from Non-Residents (Claim for Relief from Singapore Income Tax Under Avoidance of Double Taxation Agreement) that has been duly certified by the tax authority of the treaty country if, on the other hand, you are a tax resident of a country covered by the agreement.

Income Categories Typically Covered by the DTA

The following forms of income are covered by the DTA:

Contents of DTAs that Singapore has Signed

Although each DTA Singapore has signed has unique provisions and may vary from one nation to another, a typical DTA generally follows the following broad guidelines:

Permanent Establishment (“PE”) definition: PE is a notion that appears in every DTA. In general, whether an entity is taxable abroad depends on the existence of a PE. Basically, it refers to a permanent location where a business is operated entirely or in part. Examples include:

Without limiting the generality of the aforementioned, someone is considered to have a permanent establishment in Singapore if they:

Income from Immovable Property

Real estate rental income, for example, is often taxed in both the recipient’s home nation and the country of source (where the property is located). The nation of resident must permit a credit for the tax paid in the country of source, according Singapore DTAs.

Business Profits

are not taxable if they cannot be attributed to a PE. However, if a PE generates business profits, the enterprise is permitted to deduct a fair sum of expenses related to that PE.

Airline or Shipping Profits

An enterprise from one country that obtains goods or services from another country is entitled to either a full or partial exemption. When full exemption is allowed, the income from shipping or air travel will only be subject to tax in the country where the business is based.

Dividend Income

that the dividend income may be taxed in the recipient’s place of residency and that the country of source (i.e., the nation in which the firm is headquartered that is paying the dividend) has the authority to do so.

A full or partial tax exemption may be granted by the nation of origin, or a lower dividend withholding tax rate may be applied. Singapore uses a one-tier corporate structure, hence there is no withholding tax applied to dividend distributions. The domestic tax laws of the destination nation and any provisions of the treaty would determine whether they are taxable there.

Interest

will not be taxed at all or only at a lower rate in the country where the interest income is earned (source country).

Royalty Income

From complete exemption to partial exemption, tax treatment varies. It’s crucial to keep in mind that different treaties may have different definitions of royalty.

Professional Services Income

is typically taxed in the nation where the person providing the services resides. His professional services revenue will be taxed in the same way as his business profits if the person has a fixed base in Singapore (an office or clinic). Doctors, attorneys, engineers, architects, dentists, accountants, and others provide professional services.

If a person resides in Singapore for fewer than 183 days during a tax year and the services are rendered for a resident of another contracting country, some tax treaties offer tax exemption.

Income from Employment

will be subject to Singaporean taxation if the employment is performed there, unless: a. In a tax year b, the employee doesn’t spend more than 183 days in Singapore. His employer resides in the nation that is party to the agreement. Certain tax treaties additionally demand an additional requirement to be met: the employee’s income must be subject to tax in the other contracting nation. His compensation is not supported by a permanent establishment in Singapore of an entity of a contractual country.

The Source of Directors’ Fees

is in the nation where the business paying the levy has its tax residence. Normally, the entire domestic tax rate would be in effect.

Government Service Payments

Any salary, wage, pension, or other similar payment made by the government of a contracting country to an individual providing services in Singapore on that government’s behalf is free from Singaporean taxation and is only subject to taxation in the contracting country.

Remuneration Paid to Visiting Professors or Teachers

Singapore does not impose taxes on money paid by a contracting nation to a teacher employed by a Singapore-based educational institution.

Self-Employed Persons

are subject to Singapore income tax on the entire amount of the money they make there, minus any tax-deductible costs they may have paid to make that money.

The Right to Tax Capital Gains

Deriving from the sale of real estate and gains from the sale of stock vary depending on the DTAs that have been signed with various nations.

Tax Credit

Singapore will grant a tax credit for foreign income depending on the lesser of the foreign tax paid or Singapore tax payable. Additionally, income from foreign sources is not subject to tax in Singapore as long as two requirements are met: the foreign jurisdiction from which the income is received must have a headline tax rate of at least 15% in the year the income is received in Singapore, and the foreign income must have been subject to tax in the foreign jurisdiction.

Strategies to Reduce Double Taxation in Singapore

Both a country’s own tax legislation and tax treaties provide strategies for preventing double taxation. In Singapore, the following options are available:

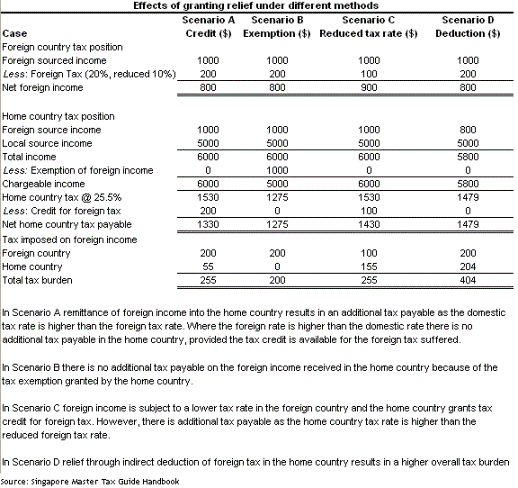

Tax Credit

A Tax payer will receive a tax credit for any international taxes paid in comparison to any domestic taxes levied on the same income. The amount of tax credit relief is typically capped at the lesser of what was paid or is payable in the home country and abroad.

In contrast to the full credit technique, which allows a complete credit for taxes paid in the nation of origin, this is known as the ordinary credit method.

In Singapore, tax credit relief is frequently referred to as double tax relief (DTR). The DTR claim must be included in the company’s tax computation and submitted with annual income tax returns (Form C).

Before DTR claims can be taken into consideration, there must be documentary evidence that the remitted income has been subject to tax in the treaty country (such as withholding tax receipts, a letter from the foreign tax authority, or dividend vouchers).

Tax Exemption

The avoidance of double taxation is made possible by the domestic tax exemption of foreign income. The complete or a portion of the foreign income may be excluded.

Tax Exemption for Foreign-Sourced Dividends, Branch Profits, and Service Income – Section 13(8) of the Singapore Income Tax Act

If the following criteria are satisfied, a Singapore tax resident firm can benefit from tax exemption on its overseas-sourced dividends, foreign branch earnings, and foreign-sourced service revenue that is repatriated into Singapore:

In addition, resident non-individuals and resident partners of partnerships in Singapore will be excluded from paying taxes on any foreign-sourced income they earn or accumulate outside of Singapore.

You don’t need to include supporting documentation with your income tax returns to prove that your specified foreign income qualifies for the exemption in order to take advantage of the tax exemption on that income (such as dividend vouchers, notices of assessment issued by the relevant foreign jurisdiction, etc.).

Instead, all you have to do is declare in the appropriate area of your income tax returns that the following information is true and your specified overseas income qualifies for the tax exemption:

Tax Exemptions for Individuals – Section 13(7A) of the Singapore Income Tax Act

If the Comptroller is satisfied that the tax exemption is advantageous to the individuals, then all foreign income received in Singapore by tax resident individuals is exempt from tax.

Reduced Tax Rate

Interest, dividends, royalties, and profits from overseas shipping and air travel are among the groups of income that are subject to a lower tax rate under this type of relief.

Relief by Deduction

In this instance, foreign tax is subtracted before applying domestic tax on the overseas revenue. Foreign income tax deductions are not permitted in Singapore.

Although a deduction is given inadvertently, Singapore would tax the amount of foreign income received (i.e., net of foreign tax) in Singapore under the remittance basis.

Tax Sparing Credit

Only if the income has been taxed in the nation of source is typically a DTA’s tax credit accessible in the country of residency. A tax sparing credit is a unique type of credit in which the country of resident agrees to grant a credit for any taxes that would have otherwise been paid in the country of origin but were “spared” due to special legislation in that nation designed to encourage economic growth.

The tax sparing credit clause is typically included in DTAs between a developed country that exports capital and a developing country that provides tax incentives to attract foreign investment. The capital-exporting nation grants the loan in accordance with its legal obligations to encourage investment.

Tax Relief Example Under Different Methods

Unilateral Tax Credit

If you are a Singapore tax resident and receive the following foreign income from nations with which Singapore has not yet signed a DTA, you may be eligible for a unilateral tax credit under Section 50A of the Singapore Income Tax Act for the foreign taxes you paid on that income.

Foreign-Sourced Royalties from non-treaty nations would also be eligible for the Section 50A unilateral tax credit if they did not:

Withholding Tax

The most frequent application of DTAs is to evaluate if it would be possible to seek a tax exemption or reduction on particular forms of income.

In Singapore, the following types of income are typically subject to withholding tax:

| Nature of Income | Withholding Tax Rates | |

| 1 | Interest, commission, fees, or any other payment related to a loan or other debt | 15% |

| 2 | Royalties or additional one-time payments for the use of mobile properties | 10% |

| 3 | Management fees | Corporate tax rate currently at 17% |

| 4 | Rent or other fees for using mobile properties | 15% |

| 5 | Technical assistance and service fees | Corporate tax rate currently at 17% |

| 6 | Any real estate that a non-resident property broker sells for a profit | 15% |

Singapore’s Tax Treaty Network

All DTAs that Singapore has signed since 1965 are divided into the following categories:

Send us your questions.

We will reply in less than 24h.

Thank you, we will contact you shortly!

Thank you, we will contact you shortly!